The value of industrial property in some regional hubs, including the Gold Coast, Newcastle and Toowoomba, is rising quicker than in capital cities because of the increased demand for space in constrained regional markets.

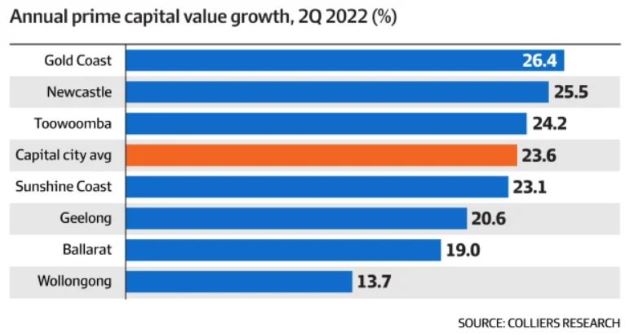

The annual growth in prime industrial property values in capital cities surged 23.6 per cent by the second quarter this year, but that rate was topped by the Gold Coast, at 26.4 per cent, Newcastle (25.5 per cent) and Toowoomba (24.2 per cent), according a Colliers analysis.

“While most of the spotlight has been on the record performance of capital city industrial markets, many regional markets around the country have outperformed their respective capital cities, led by higher levels of population growth and shifting business preferences,” Colliers research director Luke Crawford said.

“Regional industrial markets are also well-placed to weather interest rate headwinds and buffer rising fund costs, given the higher yield spread than capital city markets.”

Last year’s exuberance for the industrial market, squeezing yields and fostering deals such as the record sale of the $3.8 billion Milestone portfolio, has eased somewhat as investors adopt more caution in the face of rising interest rates.

That boom priced many investors out of capital city markets, pushing some players to move up the risk curve into higher-yielding regional markets, according to the Colliers report.

In the 12 months to June this year, yields fell across the east coast regional centres by an average of 55 basis points. Prime yields in regional hubs now average 5.4 per cent. Most of that compression took place in the second half of 2021, with yields holding mostly steady this year.

By contrast, prime industrial yields in the capital cities are averaging 4 per cent or even less.

Strong demand and low vacancy is underpinning regional markets. Supply across the markets Colliers assessed (for buildings of more than 3000sq m) fell to about 110,000sq m by June 2022 from about 260,000sq m a year earlier. There are no leasing options available above 3000sq m in the Ballarat and Sunshine Coast markets.

After prime rents picked up 9.6 per cent across east coast regional markets in the past year, Colliers is forecasting rents to rise 7.5 per cent to 10 per cent over the next 12 months, given the lack of new supply especially for buildings of more than 3000sq m.

“Land-constrained markets such as the Gold Coast are expected to see rental growth at the upper end of this scale as landlords continue to hold the upper hand with rental negotiations,” the report said.

Article source: www.afr.com